|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

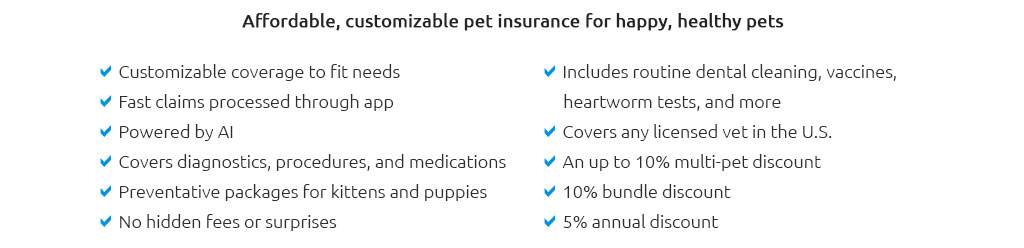

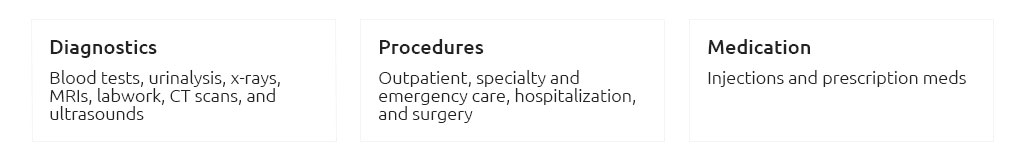

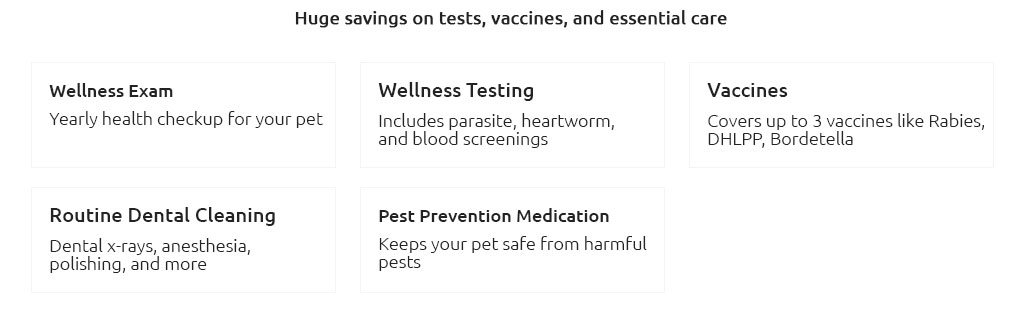

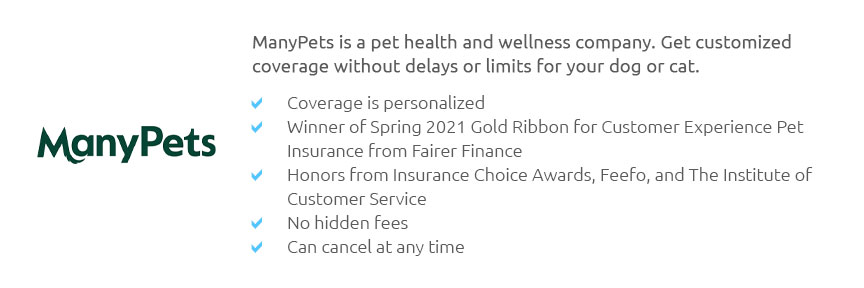

Understanding Cat Medical Insurance CostsWhen it comes to our beloved feline companions, ensuring their well-being is often a top priority, and a significant aspect of that responsibility includes medical insurance. However, the intricacies of insurance costs can be a bit perplexing. Here, we delve into the various factors influencing these costs, enabling cat owners to make informed decisions. Firstly, it's crucial to recognize that the cost of cat medical insurance is not a one-size-fits-all scenario. Several elements play a role in determining the premium you'll pay. One of the primary factors is the age of your cat. Typically, younger cats are cheaper to insure as they are generally healthier and less likely to require medical attention compared to older cats. Another essential factor is the breed of your cat. Certain breeds are predisposed to specific health conditions, which can increase the risk for insurance providers. For example, Persian cats are known for having respiratory issues, whereas Maine Coons are susceptible to heart diseases. As a result, insuring these breeds might be costlier. Additionally, the type of coverage you choose will significantly impact the cost. Most insurance providers offer several plans ranging from basic accident coverage to comprehensive policies that include wellness visits and chronic condition management. A more extensive plan will naturally cost more, but it may save you money in the long run if your cat requires frequent medical attention. It's also worth considering the deductibles and reimbursement levels. Plans with lower deductibles and higher reimbursement percentages tend to have higher premiums. However, they also reduce the out-of-pocket expenses when a claim is made, providing peace of mind during costly medical emergencies. Moreover, your location can influence insurance costs due to the varying veterinary care costs across different regions. Urban areas often have higher veterinary fees compared to rural locations, which can reflect in the insurance premiums. While navigating these options, it is advisable to compare different providers and read the fine print meticulously. Each insurer has unique terms, and some may offer additional benefits like coverage for alternative therapies or behavioral treatments, which can be beneficial depending on your cat's needs. In conclusion, cat medical insurance is an investment in your pet's health and your financial stability. By understanding the factors that affect insurance costs, you can select a plan that aligns with your budget and your cat's healthcare needs. Remember, the cheapest option is not always the best; weighing the benefits against the costs is essential for a well-rounded decision. https://www.experian.com/blogs/ask-experian/how-much-does-pet-insurance-cost/

Pet insurance costs an average of $675 annually for dogs and $383 annually for cats. However, your pet insurance premiums may be higher or lower depending on ... https://www.statefarm.com/insurance/pet/cat-insurance

Cat people are a special breed. With Trupanion, cats and cat parents get protection to cover the unexpected. https://www.pawlicy.com/blog/why-does-my-cat-need-pet-insurance/

On average, accident/illness pet insurance costs about $30 per month for cats. For younger cats, you can find plans that cost as little as $20 or less per month ...

|